PRE JOLTS ANALYSIS

Previous: 7.15M

Event: JOLTS Job Openings

Consensus: 7.21M

Macro Context

The market is currently pricing in a slight re-acceleration in job openings. However, an analysis of the relevant leading indicators points more toward a continued cooling of the labor market rather than renewed momentum.

Leading Indicators – Summary

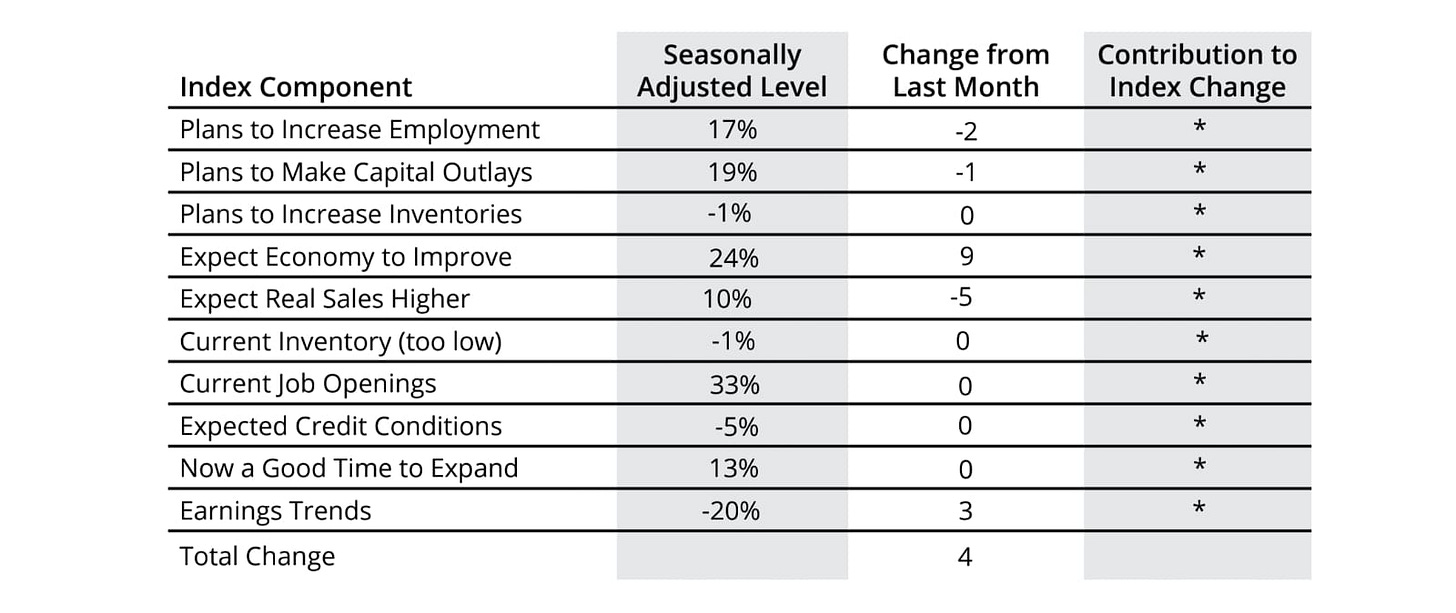

NFIB Small Business Survey

Hiring Plans: 17% (−2pp MoM)

Overall Hiring: 53% (−3pp MoM)

Jobs Hard to Fill: 33% (stable, but above historical norm)

→ Declining hiring appetite among SMEs, despite ongoing structural labor shortages.

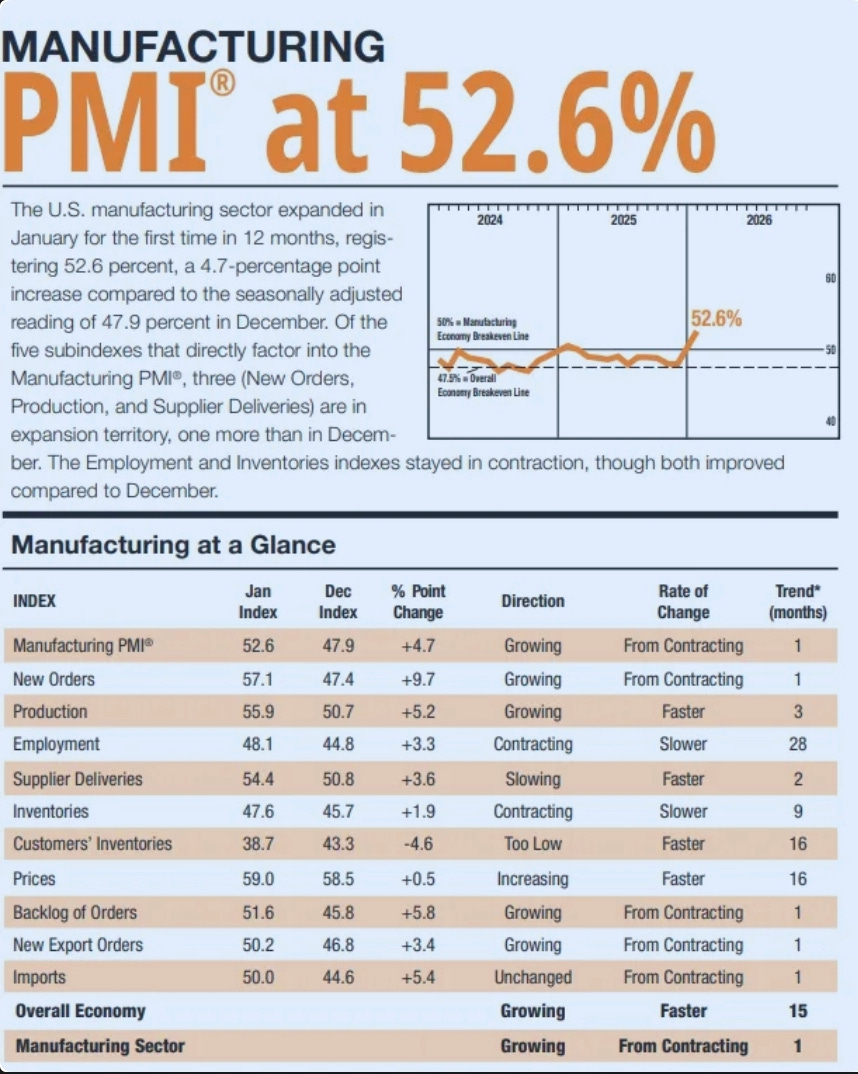

ISM Manufacturing (Update: 02.02.2025)

- Headline: 52.6% (+4.7pp MoM)

- First expansion month in 12 months

- New Orders: 57.1% (+9.7pp MoM, strongly expansionary)

- Production: 55.9% (+5.2pp MoM)

- Employment: 48.1% (+3.3pp MoM, still contracting but significantly improving)

- Backlog of Orders: 51.6% (+5.8pp, from contracting to growing)

→ Surprisingly strong cyclical rebound in the manufacturing sector. However, employment remains contracting (48.1%) and is only improving gradually. The positive effect on job openings is likely to occur with a time lag (1-2 months lag) and may not yet be fully visible in tomorrow's JOLTS print. Manufacturing accounts for ~11% of total employment and thus remains a smaller factor compared to services

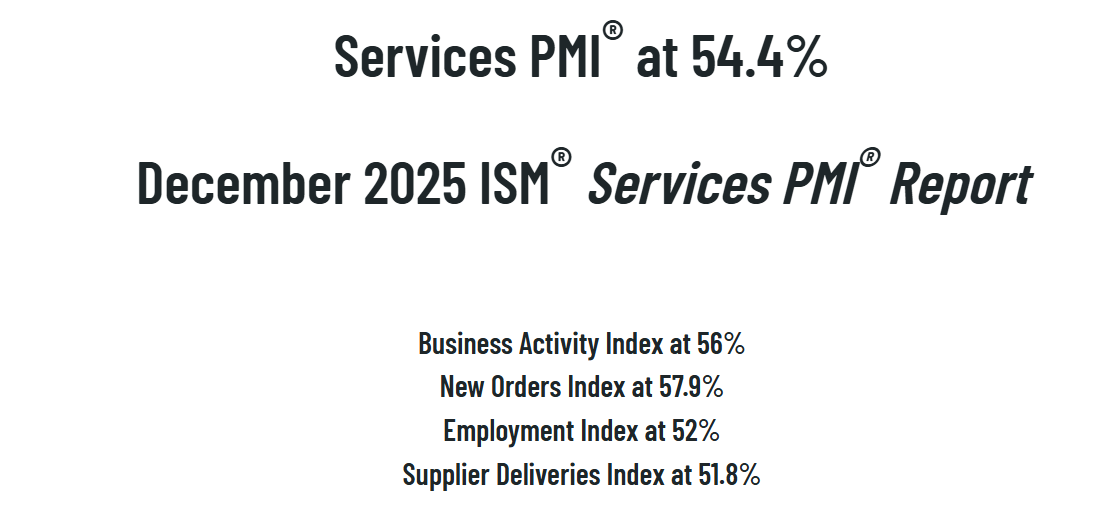

ISM Services

- Services PMI: 54.4 (+1.8pp MoM)

- Third consecutive month of expansion

→ Services are stabilizing the labor market but are not generating new breadth.

Consumer Confidence – Labor Market Differential

- Jobs Plentiful: **23.5%** (↓ from 27.5%)

- Jobs Hard to Get: **20.8%** (↑ from 19.1%)

- Expect Fewer Jobs: **28.5%** (↑)

- Expect More Jobs: **13.9%** (↓)

→ Clear sentiment shift among consumers, historically a reliable leading indicator for fading labor market momentum.

---

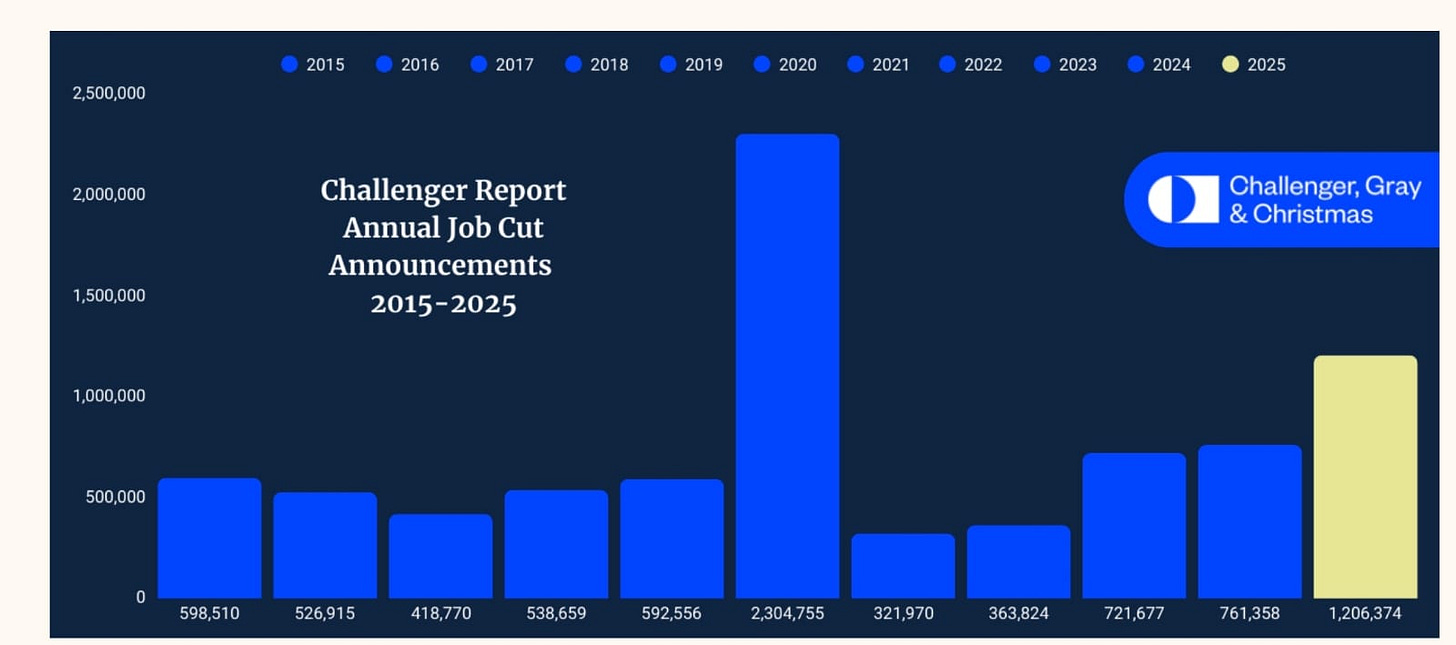

Jobless Claims & Challenger Job Cuts

- Initial Jobless Claims (4W Avg): **~206k** (stable)

- Challenger Job Cuts: **1.2M (+58%)**, highest level since 2020

→ Layoffs have been announced but are not yet fully reflected in claims. A typical lag effect.

Overall Assessment

The U.S. labor market remains **functionally stable** but is losing **momentum and breadth**.

Hiring is being deferred, while layoffs remain limited so far. The data profile is consistent with **late-cycle cooling**, not a renewed acceleration.

---

JOLTS Bias (Pre-Release)

Bias:

-**Slightly below consensus or at best inline**

- Expected range: **~6.9 – 7.1M**

- Upside above **7.2M** is considered **unlikely**

Rationale:

- Declining hiring plans (NFIB)

- Weakening consumer labor market sentiment

- Persistent weakness in manufacturing

- Services sector stabilizes but does not create new momentum

- Rising Challenger Job Cuts exert a delayed negative impact on job openings

A materially stronger JOLTS print would be primarily **lag-driven** and inconsistent with current leading indicators.